This article explains how pullbacks happen in the markets and also why they happen.

Naturally, we will also look at how traders can use pullbacks to their advantage.

This article was written specifically for users of TrendViper trend indicator, but any trader or analyst will find this information useful.

What is a Pullback

It is important to be able to recognize pullbacks because they happen all the time, especially in today’s rapidly moving markets. Whether it’s the price of a commodity, index, currency pair, or a particular stock, they all have pullbacks.

A pullback is a temporary reversal of price action within a trending market.

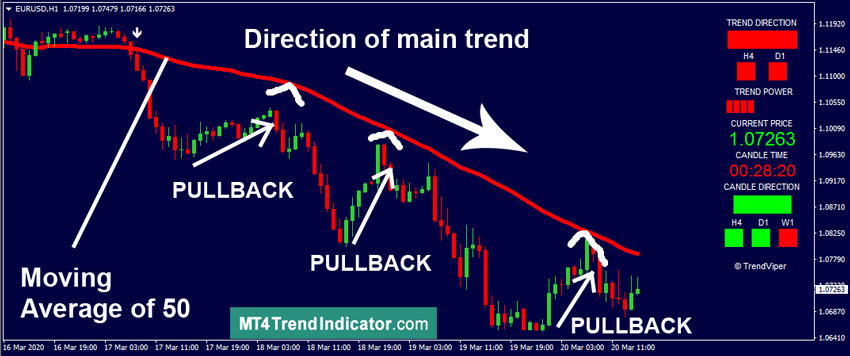

In the image above we can see that the dominating trend is a downtrend. Using the Moving Average of 50 we can see how the price action pulls back to this level a few times, yet overall the price keeps going down. We could say that the bears remain in control.

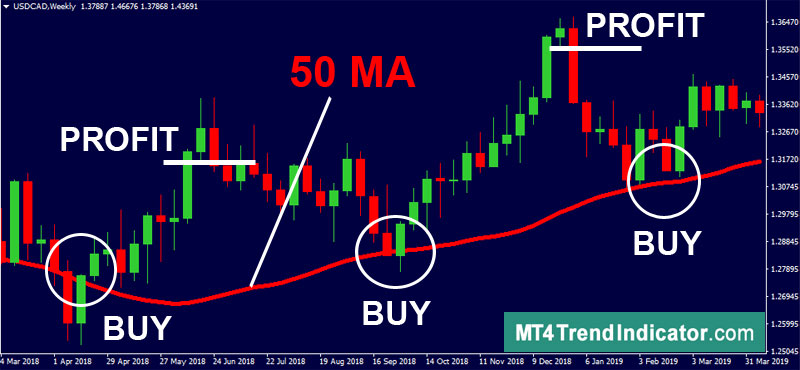

Pullbacks also happen in uptrends. As you can imagine, when the price keeps trending upwards, it can dip a few times to a certain level but overall it remains on course in an upward trajectory.

So, pullbacks can happen in bearish or bullish market conditions.

Some people refer to a pullback as price consolidation or retracement and sometimes these terms can be confusing but they generally they mean the same thing.

The common consensus is that price pullbacks are short in duration.

If the duration of the pullback is longer that a few consecutive candles, we could say that it is a price consolidation.

Why pullbacks happen

Price pullbacks are a very natural part of the market. They happen because the price action reflects the opposing forces of the market. The sellers and buyers are in constant competition and pullbacks are simply a reflection of those market forces that create trending markets.

For example, imagine that there was a very positive news about expanding Tesla production. The price of their stock shot up in response to this good news and the trend was bullish. Yet traders with already opened positions decided this was a good time to sell and reap the profits.

As a result, the price of the Tesla stock temporarily lost its bullish momentum due to these sellers. This forced the price to go down temporarily and created a pullback. After the price pulled back, new opportunistic buyers entered the market and the uptrend continued.

It’s important to understand that in trending markets there are at least three price pullbacks on average.

How to spot pullbacks

There are many ways to find pullbacks in the markets. The most common ways used by professional technical analysts is to use Moving Averages, Trendlines, Channels, Pivot or Fibonacci levels. Basically, technical indicators that mark common areas of price support and resistance.

The example below shows pullbacks along a manually plotted trend line.

In TrendViper users see Moving Averages which provide an adequate measure of price support and resistance. Especially the 21 MA, 50 MA, 100 MA, or 200 MA.

Yes, it’s entirely possible to have various areas of price support and resistance.

Which MA to use is a matter of personal trading strategy. If someone is trading short term, than 21 MA or 50 MA will work very well. For long term investors the 100 MA or even 200 MA might be more effective.

How traders use pullbacks to their advantage

Pullbacks can provide the perfect moment to enter a trending market. Traders look for price pullbacks like hawks. Once they confirm a prevailing trend, they naturally want to enter the market at the most advantageous time. Entering a trend at the pullback can offer them the highest profit margin.

Many day traders only trade pullbacks, buying and selling with each pullback. They simply scalp the trend. They buy when there is a pullback to the level of support or resistance (depending whether it’s an uptrend or downtrend), for example marked by the 50 Moving Average, and then they close the trade and take profit when the trend weakens and begins a pullback.

When the price pulls back to the support or resistance level but continues with the trend, they enter the market again. Some scalping traders can trade like this all day long. They find a strong trend and try to maximize their profits as much as they can.

Trading this way is more intense and requires more attention to the markets. Scalping the dominating trend can be an effective way to minimize losses.

How to use TrendViper trend indicator with pullbacks

At present the TrendViper indicator does not issue arrows or any signals on price pullbacks. We will most likely issue additional indicator that will generate signals on specific price pullbacks.

Having said that, traders are advised to look out for a pullback after receiving a TrendViper signal. Our trend indicator issues filtered signals on Moving Average Crossovers. It’s very common for the price action to pull back to the support or resistance level after a crossover signal.

It doesn’t always happen, but careful traders will be well advised to prepare for a pullback to the slow Moving Average. When there is an evident support or resistance visible in the price patterns and the detected trend continues, it might be a very good opportunity to enter the market.

If traders decide to enter the market immediately after receiving a TrendViper signal, they should place adequate stop loss spanning beyond the slow Moving Average. This will ensure that the price pullback, should it happen, won’t close the position prematurely.

This type of stop loss is preferred by traders who want to ride the larger trend and are not too concerned with pullbacks that could stop them out.

Another method would be to set a trailing stop loss that closes your position as soon as the price pulls back too much. Thus possibly locking the profits very early into the prevailing trend, but at the same time, defending your position against a possible loss.